deferred sales trust problems

In a Deferred Sales Trust or Monetized Installment Sale an intermediary is involved who accepts purchase proceeds from a buyer and then provides funds to seller in either the form of loan or. The Deferred Sales Trust provides a ready solution to this problem by allowing the funds to revert to a trust rather than to the investor.

Principal Agent Problem Wikipedia

Deferred sales trusts also come with a number of caveats that have the potential to increase investment risk.

. In a 1031 exchange 1033 exchange or 721. By using Section 453 of the Internal Revenue Code which pertains to. Gregory H Reese.

A Deferred Sales Trust is simply a trademark a subset of practitioners use to describe a financial structure that includes an irrevocable trust and an installment sales. The Deferred Sales Trust is a more complicated income tax structure than with other income tax planning strategies such as the 1031 exchange. Thats where the Deferred Sales Trust comes in.

Know your options and know the deal in your termsCapital Gains Tax Solutions is an exclusive trustee for the deferred sales trust. His experience includes numerous. The trust then sells the real estate to the buyer and the funds are placed in.

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. The problem is some people just dont want to go back into real estate. The problems with a Deferred Sales Trust.

A Deferred Sales Trust is a legal method for deferring capital gains even though you sell your appreciated property instead of exchanging it. A Zoom invite will be emailed with a. Please follow the instructions to add an event to my calendar.

Welcome to my scheduling page. His company helps people escape feeling trapped by Capital Gains Tax with his deferred sales trust. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now.

A Zoom invite will be emailed with a conference call. Taxpayers using the Deferred Sales Trust. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST.

We are experts and focuse. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now. Potential Disadvantages of Deferred Sales Trusts.

A Deferred Sales Trust is a legal agreement prepared by an attorney between an investor and a third-party trust in which the investor sells real estate to the trust in exchange. I want you to better understand how you can benefit from a deferred sales trust so you can make more money when you sell and have more freedom with your time. The idea behind a deferred sales trust is to sell the real estate asset to the trust with an installment sale.

Typically when appreciated property is sold the gain is. Many people that are a part of the legal and 1031 exchange community do not believe this structure is legitimate for the purposes of deferring. Please follow the instructions to add an event to my calendar.

Welcome to my scheduling page. Brett is the founder of Capital Gains Tax Solutions. Unlike a 1031 exchange a DST does.

The investor is saved from taking.

Why You Should Consider Using The Deferred Sales Trust More Than Ever

Deferred Sales Trust 101 A Complete Guide 1031gateway

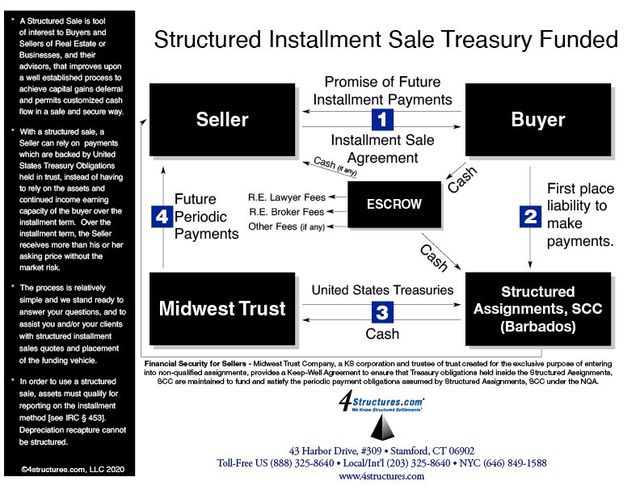

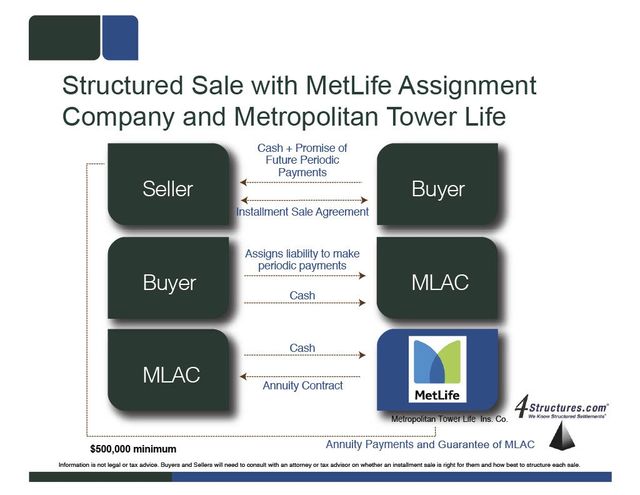

Structured Installment Sales What Are Structured Installment Sale

Estate Planning Team Dst Deferred Sales Trust

Installment Sale To An Idgt To Reduce Estate Taxes

Deferred Sales Trusts Modern Wealth

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker

Deferred Sales Trust Oklahoma Bar Association

Estate Planning Team Dst Deferred Sales Trust

Primer On The Deferred Sales Trust Dst Reef Point Llc

Don T Trust Your Broker Why I Keep My Own Records Thestockmd Com

Expenditures Of Federal Awards Sefa Schedule 16 Office Of The Washington State Auditor

Deferred Sales Trust Dst Capital Gains Tax Avoidance

Is The Legal Fee For The Deferred Sales Trust Worth It

![]()

Podcasts Capital Gains Tax Solutions

How To Eliminating Capital Gains Tax Using A Spendthrift Trust

Pros And Cons Of Investing In A Delaware Statutory Trust

Structured Installment Sales What Are Structured Installment Sale

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax